By continuing use of this site you agree to use of cookies as per Privacy Policy

The cash flow statement is a report that gives details about the company’s cash flow over a time period. Let’s check importance of cash flow in decision making.

The Cash Flow Statement (CFS) tells you exactly how money flows in and out of your company. It is a report that helps visualize the income and expenditure of the company. Investors and business managers alike can use the report to determine if the company is managing its finances optimally or if there is room for improvement. A healthy cash flow is a positive indication of good financial management and a robust company. A cash flow statement may not indicate unwise spending but may also reveal that the company has become very sluggish in its operations.

The cash flow from operations is voluminous. It extracts information from the daily transactions relating to core operations. The CFO reports the transactions from the accounts receivable, accounts payable, etc. It helps the reader determine how much money the company is transacting. It is also informative for the company’s stakeholders to determine how the operations are being run.

Companies use their money to invest in property, equipment, vehicles, stocks, and bonds. These investments or capital expenditures are a part of the cash flow from investing.

The transactions of a company for financing-related activities such as loan payments, issue of stock, dividend payments, and transacting bonds comprise the CFF section of the cash flow report.

Net Cash Flow: The sum of the different cash flow activities makes up the net cash flow. We can calculate the net cash flow as:

Net Cash Flow = Cash Flow From CFO + CFI + CFF

The cash flow report helps visualize the cash flow of a company, and it also helps the reader evaluate the historical and current cash flow patterns of the company. This can be used to generate cash flow projections, study how the company has evolved, and estimate how it is expected to perform based on its record.

An investor would want to put money into a business that is likely to perform well and grow. In addition to the balance sheet and income statement, a careful perusal of the cash flow statement is important to understand how the company is managing its money. The importance of cash flow statement lies in the fact that it gives a more detailed picture of the company’s finances than the other statements. It also shows the balance between the operational, investment, and financial activities of the company. It tells the investor how solvent the business is, which is an essential aspect of the company's financial stability. While the overall reports of the company give the investor the bigger picture, the cash flow statement reveals just how much of the cash flow generated is a part of the company’s core business activities. The comparison of the cash flow statements of similar companies reveals a lot about their difference in managing their finances. If the company is carrying a debt burden, the cash flow statement helps the investor assess the company’s capability of repaying the debt. By making projections from the cash flow statement, the timing and volume of the future cash flows can also be estimated. This is another importance of cash flow statement.

Cash flow analysis calculates different ratios that give a numerical evaluation of the company's cash flow. The essential cash flow ratios are:

Operating Cash Flow Ratio: This is the cash flow ratio that reveals the company's liquidity. It helps the financial analyst or investor calculate if the company’s operational cash flows are sufficient to cover its liabilities.

The formula for the operating cash flow ratio is:

Operating Cash Flow Ratio = Cash Flows From Operations / Current Liabilities

The cash flow from operations can be extracted from the cash statement, and the current liabilities are listed on the balance sheet. If this formula calculates a value less than one, it means that the company is generating insufficient money to repay its debt which is a red flag for the investor.

Cash Flow Margin Ratio: This ratio tells us about the company’s ability to translate sales activities into cash. It is the percentage of the cash from operating activities versus the sales activities of the company. The cash flow margin should be as high as possible. The formula for calculating the cash flow ratio is:

Cash Flow From Operating Cash Flows / Net Sales = _____%

Current Ratio: The ratio between the current assets and the current liabilities of the company is the current ratio and it indicates if the company has enough current assets to cover its liabilities. It is also a measure of the company's liquidity and indicates how well it can meet its short-term debts.

Current Ratio = Current Assets / Current Liabilities

Quick Ratio: This is the most specific test of the company’s liquidity. Most ratios that measure liquidity also include inventory as a part of the calculations. The quick ratio is called the acid test because it does not include inventory. It determines if the company has enough liquidity without the option of selling inventory to meet its short-term liabilities.

The formula for quick ratio is:

Quick Ratio = Current Assets - Inventory / Current Liabilities

If the calculation results in a number that is less than one it means that the company would have to liquidate inventory to meet short-term obligations and this is not an indication of good financial health.

Regular cash flow analysis tells you how well your company is managing its cash flows. This report is traditionally calculated annually. But with software like TallyPrime that holds all the accounting data in one place, you can generate a cash flow report for smaller periods. The specific insights that this report gives you will help steer your company into better cash management practices. Good cash flow and management results in excellent financial health. The importance of cash flow statement is that it zooms in on the bigger picture that the balance sheet and income expense statement give you and lets you analyze the cash flow independently.

The cash flow statement is a report that gives details about the company’s cash flow over a time period. Though the term ‘cash’ is used, it also applies to cash equivalents. It details the amounts of money that the company is earning and spending, showing how the cash flow has changed in that time.

The cash flow statement is an essential document for investors and stakeholders in a company and is prepared annually from the operating, investing, and financing activities but can even be made for shorter time intervals. Cash flow analysis is the study of the cash flow through the business. The utilization of cash flow data to project future cash flows is called cash flow forecasting.

The activities that reflect on the cash flow statement include:

Operational activities: These activities are integral to the company's purpose and include revenue income, payments to vendors, cost of utilities, and other such transactions.

Financial activities: Activities that involve the capital of the company, borrowed money, and transaction of securities are financial activities. They are separate from operational activities.

Investment activities: The losses and gains of the company through activities such as buying/selling of assets and loan payments are investment activities.

So, the cash flow statement lets the business owner and management of a company track the cash flow in the company from all streams in a single report.

Accounting is an essential part of running a business of any size. Most accountants maintain accounts strictly adhering to the commonly accepted accounting principles and regulations. However, within the accepted principles there is some flexibility in the methods of accounting that a business uses. One of the preferred and most popular methods is the cash basis accounting method. It is very straightforward and easy to understand and implement. The cash basis accounting method recognizes the receipt or payment of cash as it happens. This is one of the main reasons why it is easy to implement even with users and business people who have little accounting knowledge. Read on to understand what is cash basis of accounting.

Cash basis accounting is the method of accounting that records the payment and receipt of cash as it happens. It is the simplest form of accounting that is often used in small businesses and proprietorships because of its ease of use. It is especially easy to implement in a business that has no inventory.

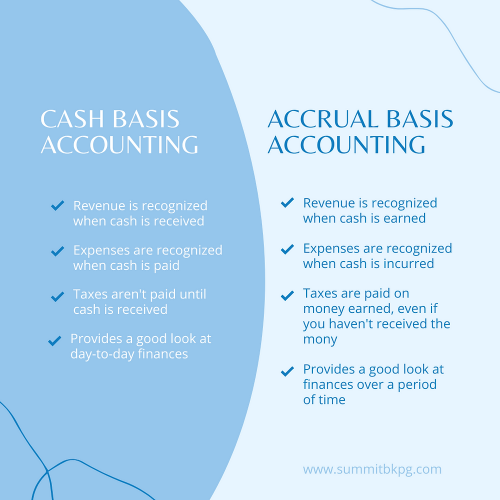

The alternative system of accounting is the accrual basis of accounting that matches the revenue and expenses and records the expenses and revenues within the same accounting period. The recording of the revenue and expenses does not always happen when the cash is paid or received. The cash paid or received without the matching counterpart of revenue or expense is recorded as a deferred entry that is later adjusted. While smaller businesses are able to maintain accounts records easily with the cash basis of accounting, they often adopt the accrual-based accounting when they grow in size. When you work with TallyPrime to manage your business accounting, you will be able to work with either cash-based or accrual-based accounting effortlessly.

Cash basis accounting is useful because of its simplicity, but it has many drawbacks. The accrual-based system is more complex but is also widely used. The revenues or expenses are recorded only when they are matched with their counterpart and not at the time when the actual cash transaction takes place. Since the cash basis shows the actual cash position and not the revenue that has been earned, it can give a falsely positive picture of the finances of the system. The accrual system gives a more realistic picture of the company’s finances, revenue, and income. The accrual system gives a more complete balance sheet. This is because the net income for a cash basis accounting system is based only on the cash received, but that of the accrual system is based on the revenue and not the cash received. The accrual system follows the matching principle of GAAP and is a better system for large organizations and businesses with inventory.

Let us take the example of a company that has been awarded a huge maintenance contract. The terms of the contract state that they will be paid in one payment after the end of the one-year contract period. In this scenario, the company would be performing the service throughout the period. By the cash basis accounting system, they will only record the payment for the service at the end of the year when they actually receive it. So, for the entire contract period, the books of accounts would show that the company is not generating revenue.

If we take the opposite, the company may receive a huge advance payment for a long contract of a year. They will record the revenue when they receive it at the beginning of the contract period. Throughout the rest of the period, the accounts will only show the expense of the project and it would appear that there is no revenue. If the cash payment falls outside the accounting year, the company’s books of accounts may show a very misleading picture of the company being idle for the year when in fact, it has been working on a lucrative contract. The books of accounts may even show a loss for the year.

Easy to use: Most small businesses have limited staff. The owner of the business usually handles the accounting of the business as well. Cash basis accounting is very simple to maintain because it tells the owner exactly how much cash there is on hand, and it is a very easy method. Since cash receipts and payments are recorded as they happen, there is no need for an accountant to manage the business accounts. Many simple software programs are able to handle the easy cash basis system of accounting. TallyPrime can be used in a simple cash basis accounting application just as efficiently in a more complex accrual-based accounting system.

Tax: Some accountants prefer to use the cash basis system of accounting because it may offer tax benefits by accelerating some payments and reducing the taxable profits. So, it is applicable in cases where it can be used to defer tax liability.

The cash basis method has some inherent disadvantages.

Can be misleading: a company may have a decline in business orders for one month. But, if many customers make payments in that time period, it will give a false picture of a boom in business. The cash basis accounting system only reflects the cash status of the company and cannot be relied upon in order to judge the actual revenue and expense that the business is generating. Using such trends for analysis, projections and planning will give highly inaccurate results.

Accuracy: The timing of the cash payments and receipts may not exactly match the actual revenue generation and expense activities. So, if a company is spending toward a project that will only pay at the end of the period, the records will only show the expenses without the revenue that is being earned through the expensing activity. This is the picture that the books of accounts will present until the company finishes the project, issues the invoice, and collects the payments.

Easy to manipulate: A business can alter its results by not encashing a cheque immediately or by manipulating the cash receipt payment. The tax component of the income then gets deferred to the next accounting period.

Raising funds: Since many financial institutions do not rely on cash-basis accounting, a business following the system may find it hard to obtain a loan. However, small businesses and proprietorships may not be subject to such stringent rules.

Auditing: If a business wants to start auditing its accounts, it would have to switch to the accrual-based system of accounts. Auditors will only issue audited financial statements for companies that maintain their financial records with the accrual-based accounting system.

Reporting: The reports of the cash-based system are highly unreliable and cannot be used to track and analyze the company’s performance or finances.

These disadvantages are the reasons why most companies switch to accrual-based accounting as they grow in size. Intelligent accounting software such as TallyPrime helps even small businesses to take advantage of the cash accrual system of accounting.

To choose between the cash and accrual basis of accounting systems, we must first understand what is cash basis of accounting and its feature comparison.

Feature | Cash Basis | Accrual Based |

Ease of use | Very simple and straightforward to use | More detailed and complex to understand and use |

Timing | Revenues and expenses are recognized when cash is received, or paid | Revenues and expenses are recognized only when they are earned |

Management of credit | Accounts receivable and payable are not maintained | There is a record of the receivable and payable which gives a complete picture of the finances |

Net income calculation | Net income is calculated based on the cash that flows in and out. Can be very inaccurate | Net income is calculated by factoring the precise revenue and related expenses, which is more accurate |

GAAP | Does not follow the matching principle of GAAP | Follows the GAAP matching principle |

Application | Is easy to use in personal accounts, small proprietorships, and small-scale businesses | Is used by large organizations that need to file audited financial reports, and statements |

Another term that is used for cash basis accounting is cash accounting.

Cash basis accounting is best for a business that needs to track cash and record transactions simply. It is not suitable for a business that has inventory, loans, or long-term liabilities.

Despite its shortcomings, cash basis can be used for certain applications. It is primarily suitable for small, simple businesses that do not have inventory. It is also suitable for small associations and non-profit organizations.

Cash basis accounting is best suited for businesses that have the following features:

TallyPrime is the best choice of accounting software for small simple businesses and more complex accrual-based accounting systems. It allows you to grow your business and switch your method of accounting without having to reinvest in new software. The design and layout of TallyPrime easily reflects all your transaction entries in the correct books of accounts. Tally allows you to maintain your daily accounting records with minimal fuss and without the need for an accountant. It also makes auditing by an accountant easier and quicker.

Accounting software allows businesses to enhance their financial processes, reduce human error & improve accuracy. Let’s understand why your business needs accounting software.

Right from managing and tracking orders to taking care of revenue, expenses, and cash flow, as a business owner you need to manage multiple things to ensure seamless operations. Amidst all these things, having the right accounting software that supports growth while helping in predicting, planning, and controlling financial processes strategically has become an imperative factor for any small business to thrive.

As a small business owner, when you harness accounting software, you get an overview of what's happening in terms of all financial aspects of your company. This, in turn, aid in optimizing profits, ensuring business longevity, maintaining seamless cash flow, and minimizing expenditures while assisting your business to reach its goals. It also helps manage all your banking transactions, reconciliation, outstanding interest, and more.

In case you are wondering why you should opt for accounting software over traditional tools like Excel spreadsheets, then here's what you need to know:

With TallyPrime, you get valuable business insights that help run smooth business operations by automating tasks like generating timely accounting and financial reports, record-keeping of banking receipts, and much more.

Accounting software allows small businesses to enhance their financial processes, reduce human error, and improve accuracy. Here are some of the key benefits of having advanced accounting software:

Enables better financial control

For any business, having control over its financial processes is a crucial aspect. Having accounting software allows businesses to manage their finances automatically by providing in-depth insights. With all accounts-related functions integrated into a single suite, it helps in inventory management, tracking all finance-related transactions while providing real-time reports that assist business growth.

Optimizes invoice management

Invoicing and billing are the two important factors that directly impact the cash flow for any thriving business. A robust accounting software, allows you to manage to invoice automatically, send timely payment reminders, and much more while ensuring your business runs smoothly.

Helps save time and become cost-efficient

Maintaining accounts manually is a tedious task that requires human intervention and can even cause errors as well. Whereas, having accounting software in place can help your businesses in:

Improves data accuracy

For any business, having accurate data is a critical aspect of ensuring seamless cash flow, and embracing accounting software is one of the ways to ensure just that. Unlike legacy tools like a spreadsheet, accounting software helps facilitate data analysis that ultimately helps in optimizing processes and creating smarter strategies, thus improving decision-making.

Remember that any discrepancy in financial data could lead to crises, and having accounting software in place can help keep these issues at bay.

Maintains stable cash flow

Cash projection is one of the critical aspects of any business. Robust accounting software helps in closely tracking your accounts receivables and payables while ensuring stable cash flow. It provides real-time insights into pending bills, bills aging analysis to understand the long pending bills, thereby helping in managing payment frequency while making the accounts receivables process more effective.

Improves inventory management and streamlines processes

From purchase orders to sales, any business requires optimum inventory management to ensure smooth operations. Advanced accounting software helps you track stock changes owing to purchase or sales, and analyze whether you are overstocking or understocking your inventory, thereby helping in optimum inventory management.

With TallyPrime's inventory management module, you can track all your inventory across locations, maintain records of new purchases and sales, get stock summary reports, and much more.

On the go access to business information

One of the key benefits of having accounting software in place is that it allows you to manage and get insights on all financial activities on the go – from invoice management to tracking expenses, cash flow, and much more.

The Bottomline

From managing all accounting-related tasks, tracking inventory movement, maintaining transactions to getting real-time reports, accounting software is key to thriving in today's highly competitive business world. Just ensure that you pick the best accounting software available in the market that would help manage your business processes efficiently.

TallyPrime empowers business owners to efficiently run their venture by simplifying all aspects of business like accounting, sales, inventory, and more. By harnessing TallyPrime, you can ensure seamless accounting and inventory tasks, while being tax compliant. Take a look at TallyPrime’s features.

Read more on accounting software:

Registration